Singapore and Malaysia launch cross-border QR code payments system

The Monetary Authority of Singapore (MAS) and Bank Negara Malaysia (BNM) have launched an interoperable cross-border payments system, enabling residents of Singapore and Malaysia to utilize contactless QR code-based payments for both goods and payments. Singapore Malaysia cross-border QR code payments

Customers of participating financial institutions can scan physical QR codes displayed by merchants to make in-store retail payments when visiting the other country. Additionally, the system supports online cross-border e-commerce transactions.

QR code payment systems of Nets and DuitNow linked for greater efficiency

“In the next phase, MAS and BNM plan to expand the payment linkage to enable cross-border account-to-account fund transfers and remittances. This will allow users to make real-time fund transfers between Singapore and Malaysia conveniently using just the recipient’s mobile phone number via PayNow and DuitNow. This service is expected to go live by end-2023,” the two central banks explain.

The banks have linked the QR code payment systems of Nets in Singapore and DuitNow in Malaysia to create a system that provides a more efficient and seamless means of making and receiving payments for both merchants and consumers.

How do you use it? Singapore Malaysia cross-border QR code payments

If you’re in Singapore, you’ll be able to use any of the aforementioned apps and services to pay for stuff at participating merchants as long as you look out for the Singaporean NETS QR code. According to the NETS website, at most hawker centres, coffee shops and canteens, there ought to be a printed NETS QR or SGQR label near the cashier. At most other retail stores and merchants meanwhile, it’ll either be displayed on the terminal screen or on the printed receipt.

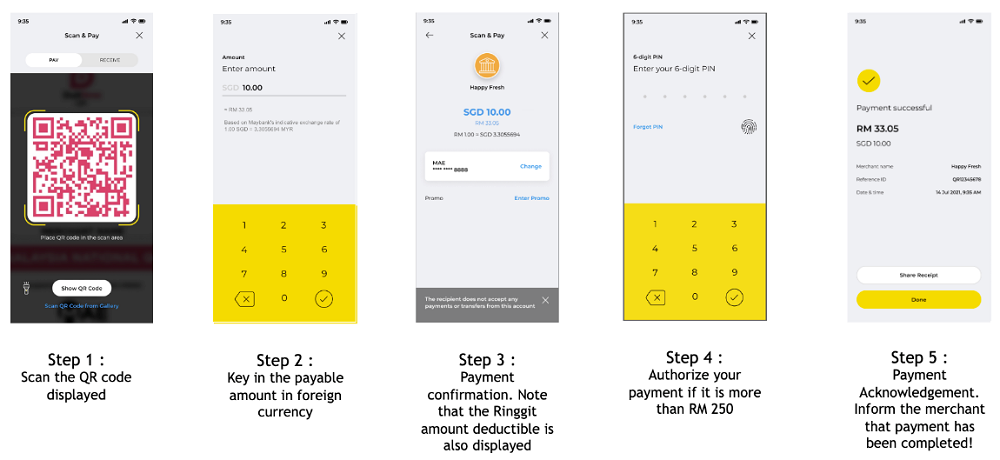

The specifics will be slightly different depending on which app you use, but for the most part, the payment process will be the same. All you have to do is open up your payment app and scan the NETS QR code with your smartphone, enter the amount needed to make the payment and once it’s done you can then show the confirmation screen to the merchant.

Taking Maybank for example, you’ll need to use the MAE app to scan a NETS QR code while in Singapore. Then, you’ll need to key in the payable amount in the Singapore dollar, and after that, you’ll get a confirmation screen showing both the Singapore dollar amount and the ringgit amount too. You may need to then authorize the payment if it’s more than RM250. Once that’s done, you’ll be shown the payment acknowledgment receipt, after which you can show the merchant.

This development comes after MAS, BNM, and the central banks of Indonesia, Malaysia, the Philippines, and Thailand announced their plans to create an interoperable cross-border payments system for all five countries in July 2022. In June 2021, BNM and the Bank of Thailand introduced real-time cross-border QR payments between the two countries.