MVNOs Are No Longer Just Telecom — Banks and Retailers Are Taking Over

Mobile services used to be a closed club. You either bought a plan from a traditional telecom operator or you did not. That model is quietly breaking apart. Today, fintechs, retailers, and digital brands are stepping into mobile connectivity, not as experiments but as strategic extensions of their core businesses. fintech MVNO

According to new research from Juniper Research, this shift is not marginal. By 2030, more than 438 million people globally will be using MVNO services, up from around 333 million in 2026.

That growth is not being driven by telecoms themselves, but by companies that were never meant to sell SIM cards in the first place.

What changed is not consumer demand. It is infrastructure.

MVNOs move from telecom niche to business tool

For years, launching a Mobile Virtual Network Operator was expensive, slow, and risky. Brands had to commit to long-term wholesale capacity, build complex systems, and accept telecom-grade operational headaches. That model excluded most non-telecom players.

The emergence of “MVNO in a box” platforms has removed those barriers. These turnkey, cloud-based platforms allow companies to launch branded mobile services quickly, flexibly, and with far lower upfront risk. Juniper estimates this market alone will reach $1.9 billion by 2030.

What matters is not the label. MVNO in a box, MVNO-as-a-Service, Telecom-as-a-Service – they all point to the same shift: connectivity becoming a modular product that brands can plug into existing ecosystems.

That is why banks, retailers, and even influencers are suddenly in the telecom business.

Why consumers accept non-telecom mobile brands

One of the most important insights from the report is simple: users no longer care who owns the network. As long as coverage is solid and pricing is fair, MVNOs are seen as equivalent to traditional operators.

The reasons MVNOs resonate are consistent across markets:

Lower costs and simpler plans

MVNOs use spare network capacity and lean operating models, allowing them to offer cheaper and more flexible plans without long contracts.

Familiar brands and bundled value

A bank, supermarket, or digital app already has trust, data, and daily engagement. Mobile service becomes an add-on, not a decision from scratch.

Personalisation and niche targeting

Unlike large operators, MVNOs can tailor plans for specific audiences: international callers, travelers, loyalty members, or digital-first users.

This explains why MVNOs are no longer just budget options. They are becoming contextual services, embedded into everyday digital lives.

Why enterprises are launching mobile services now

Juniper categorises enterprise MVNOs into three broad strategies, but in reality, most launches blend all three:

Revenue-driven models

Designed to compete openly with telecom operators on price and volume.

Customer-driven models

Built to reduce churn, increase loyalty, and raise lifetime value within an existing customer base.

Superapp strategies

Connectivity becomes one more essential service inside a broader ecosystem that includes payments, banking, retail, or subscriptions.

What connects all of them is control. Mobile services lock users in. If your phone number, data plan, and daily app usage all sit inside one ecosystem, switching becomes frictional.

That is not telecom logic. That is platform logic.

Fintechs lead the MVNO wave

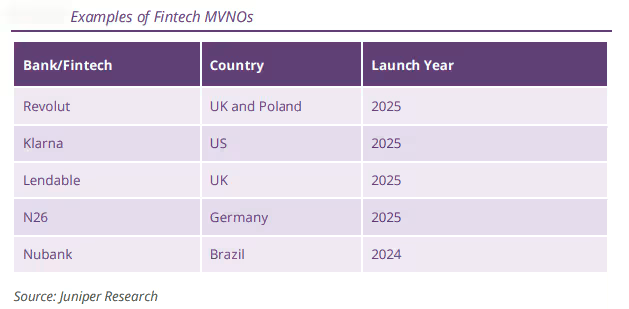

Fintechs are currently the most aggressive new entrants. Juniper highlights launches from Revolut, Klarna, Nubank, N26, and others since 2024.

This makes sense. Fintechs already have:

- Verified users via eKYC

- Strong mobile-first engagement

- Subscription or freemium pricing models

- Ambitions to become superapps

Adding connectivity strengthens all of that. It creates new revenue streams while increasing product stickiness. For players like Revolut, mobile service is not about undercutting telecom operators. It is about keeping users inside the app.

The strategic challenge here is data. Banks want insight into usage, but regulation and operator agreements complicate access. MVNO platforms that can navigate this responsibly will dominate fintech partnerships.

Retailers turn loyalty into connectivity

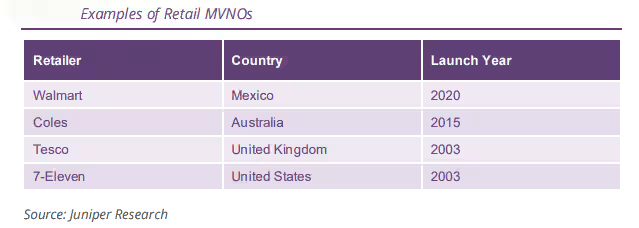

Retailers were early MVNO adopters and remain among the most successful. Brands like Tesco, Walmart, Carrefour, and 7-Eleven have proven that massive customer bases and physical distribution still matter in telecom.

What is changing now is focus. Instead of competing nationally on price alone, many retailers are shifting toward ecosystem-only mobile plans, available exclusively to loyalty or premium members.

Mobile service becomes a loyalty engine:

- Extra points

- Exclusive discounts

- Priority access

- Higher average spend per customer

This aligns with broader retail trends where data integration and customer lifetime value matter more than standalone margins.

Celebrity MVNOs: hype is not the product

Celebrity-backed mobile brands attract headlines, but Juniper is clear: fame alone does not build sustainable MVNOs.

Mint Mobile succeeded not because of Ryan Reynolds’ marketing, but because of aggressive pricing, prepaid bundles, and clear consumer value. That same rule applies to newer celebrity launches.

Influence amplifies distribution. It does not replace product-market fit. MVNOs that fail to innovate on pricing, plans, or experience will not survive, regardless of who promotes them.

Big tech remains cautious

Despite speculation, large technology platforms have largely stayed out of launching their own MVNOs. The reasons are pragmatic: complexity, limited incremental revenue, and global rollout challenges.

Instead, big tech prefers partnerships and bundling. That may change as MVNO platforms mature, but Juniper expects fintechs and retailers to remain the dominant non-telecom players through the decade.

The real risk brands worry about

Across all sectors, brand damage remains the number one concern. A poor mobile experience does not just lose a customer. It damages trust in the entire brand.

That is why MVNO platforms are no longer judged only on speed to launch or pricing. They are judged on:

- Network quality

- Customer support performance

- CRM and analytics depth

- Integration with existing systems

Connectivity is now part of brand experience, not a standalone utility.

Conclusion: Mobile connectivity is becoming invisible infrastructure

The most important takeaway from this shift is not MVNO growth. It is what mobile service represents now.

Connectivity is no longer a product you sell. It is infrastructure you embed.

Fintechs use it to deepen ecosystems. Retailers use it to extend loyalty. Digital platforms use it to reduce churn. Compared with traditional MVNOs that compete on price alone, these new entrants compete on context, data, and integration.

The trend is clear. As MVNO in a box platforms mature, mobile services will increasingly disappear into apps, memberships, and subscriptions. Users will not “switch operators” anymore. They will simply stay where everything already works.

That is not the future of telecom. It is the future of digital business.