Middle East Smartphone Market to Grow 6% in 2023; Apple Loses Share

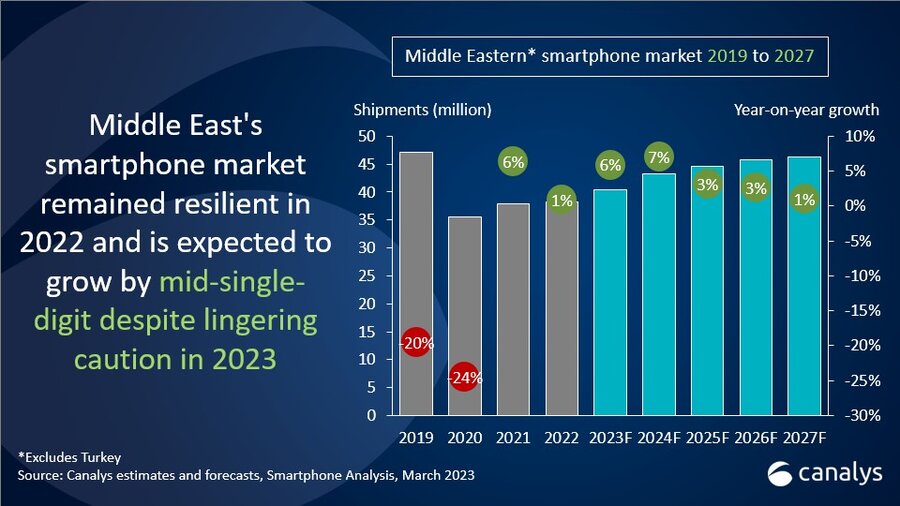

Canalys research shows that the Middle East smartphone market (excluding Turkey) is expected to grow 6% in 2023 to 40.4 million units. Middle East smartphone market

Saudi Arabia, the largest market in the region, is expected to expand by 9% as foreign direct investments increase and the market shifts from a conservative to an open economy. The UAE’s smartphone market is forecasted to increase by 6% due to the country’s robust expansion in non-oil industries like real estate, tourism, and trade. Iraq, a cash-driven consumer market, showed strong potential in 2022 but needs restructuring policies to fight forex fluctuations. In comparison, Kuwait and Qatar are expected to grow marginally, following the momentum of rising oil prices and the FIFA World Cup in 2022, which increased travel and retail sales.

Samsung Dominates Middle East Smartphone Market, Apple Losing Ground Middle East smartphone market

Apple has lost a significant share in the Middle East smartphone market during 2022 to main rival Samsung, Canalys research shows. “Samsung and Apple continue to be the defacto brands in the channel with strong power to stimulate sell-through. On the other hand, emerging vendors still face challenges to drive more sell-in as channels cannot take in more inventory,” said Manish Pravinkumar, Senior Consultant at Canalys. “While Samsung is bolstering its position in the premium market with more supply and marketing investment in its recently announced S23 series, the supply of iPhones to the Middle East region is anticipated to rise in upcoming quarters. Emerging brands such as Xiaomi, Infinix, and Tecno will learn from their current challenges in channel management. Given retail channels’ demand for better profitability, these brands will look to incentivize the channel by offering rebates while restraining their spending in ATL marketing.”

“Middle East markets witnessed a post-pandemic shift in consumer and commercial dynamics,” said Sanyam Chaurasia, Analyst at Canalys. “2023 will bring a favorable business environment, supported by buoyant energy prices, recycling of the funds from oil towards reform programs in each country and creating space for further intra-GCC business investment. Meanwhile, telcos will aggressively push 5G to echo the government’s digitalization objectives. There will be more collaboration with smartphone brands on flagship 5G smartphone launches to increase average revenue per user (ARPU).”

“The ongoing 5G development will see a transformation within the smartphone user experience and drive the other digital ecosystem. Canalys expects half of the smartphones shipped in 2023 to be 5G-enabled. The regional competition remains stiff in the coming years, especially for emerging brands. The players with better inventory management capability and channel relationships will stand out in the upcoming quarters. Smartphone vendors should focus on organized retail – the most critical channel for consumers to experience newer products and technology. This is critical for the market challengers to have a significant store presence to stand out in brand awareness and win consumer mind share,” added Pravinkumar.

Middle East smartphone shipments and growth

|

|||

Vendor |

2022 market share |

2021 market share |

|

Samsung |

40% |

34% |

|

Xiaomi |

14% |

15% |

|

Transsion |

13% |

15% |

|

Apple |

13% |

17% |

|

OPPO |

5% |

4% |

|

Others |

15% |

15% |

|

Note: Xiaomi estimates include sub-brand POCO and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding.

|

|

||

Rising and Falling: A Look at the Shifting Smartphone Brand Landscape in the Middle East

Apple has lost its share in the smartphone market in the Middle East to 13 percent in 2022 vs 17 percent in 2021. Apple was the second-largest smartphone brand in the Middle East in 2021. The supply of iPhones to the Middle East region is anticipated to rise in upcoming quarters, Canalys said.

Xiaomi has also lost its share in the smartphone market in the Middle East to 14 percent in 2022 vs 15 percent in 2021. Xiaomi became the second-largest smartphone brand in the Middle East in 2022 beating Apple.

Transsion has also lost its share in the smartphone market in the Middle East to 13 percent in 2022 vs 15 percent in 2021.

OPPO has enhanced its share in the smartphone market in the Middle East to 5 percent in 2022 vs 4 percent in 2021.