Luxury Travel Market to Reach $2.15 Trillion by 2035 as Demand Shifts to Wellness & Authentic Experiences

For decades, the idea of “luxury travel” has been associated with five-star hotels, first-class flights, and exclusive resorts. But in 2025 and beyond, the definition of luxury is evolving far beyond marble lobbies and champagne service. Today’s affluent travelers—whether baby boomers spending their retirement wealth, millennials seeking Instagram-worthy adventures, or high-net-worth individuals demanding privacy and exclusivity—are fueling a global market that blends indulgence with authenticity. From private yacht charters in the Mediterranean to immersive culinary tours in Japan, luxury travel is increasingly about experiences, personalization, and sustainability rather than just opulence.

At the same time, the luxury travel industry is becoming one of the fastest-growing sectors in global tourism. Economic recovery post-pandemic, rising disposable incomes in emerging economies, and the surge of digitally enabled booking platforms are driving unprecedented demand. Consumers are willing to pay more for once-in-a-lifetime journeys, wellness escapes, and eco-conscious adventures that align with their values.

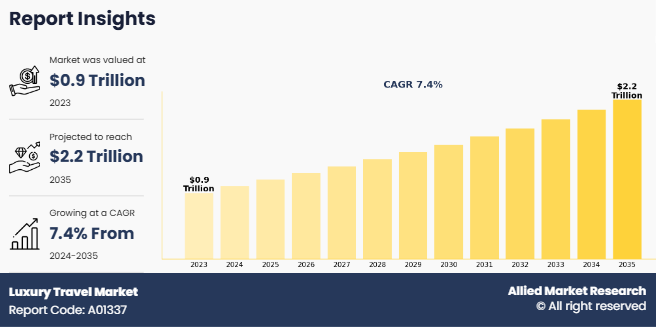

A new report from Allied Market Research puts concrete figures on this trend: the luxury travel market, valued at USD 890.8 billion in 2023, is projected to more than double, reaching USD 2,149.7 billion by 2035. That’s a steady 7.4% compound annual growth rate (CAGR) over the forecast period, signaling both resilience and transformation in a sector often viewed as niche. Importantly, luxury travel isn’t just about the ultra-rich anymore—it’s also expanding into the realm of “affordable luxury,” making aspirational experiences more accessible to wider traveler segments.

This growth trajectory, supported by other independent forecasts from Grand View Research, Research & Markets, and Market Research Future, underscores one clear message: luxury travel is not only rebounding—it’s redefining the future of global tourism.

Defining Luxury Travel

Luxury travel stands for more than upscale lodging—it’s about tailored, premium experiences. This includes private transportation, bespoke itineraries, exclusive cultural excursions, fine dining, and concierge services crafted to a traveler’s preferences.

What’s Driving This Growth?

- Rising Disposable Incomes: Growth in income among the middle and upper-middle classes—particularly in emerging economies—is fueling demand for indulgent travel.

- Unique, Immersive Experiences: Affluent travelers are choosing adventures that connect them with local cultures, gastronomy, and nature—over traditional luxury perks.

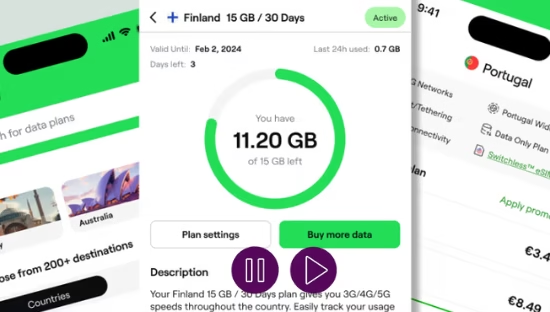

- Digital and Virtual Innovation: Tech is reshaping the journey—from VR previews and AI-driven itinerary planners to mobile concierge apps.

Market Segmentation Snapshot

| Segment | Key Insights |

|---|---|

| By Tour Type | Adventure & Safari held the largest share in 2023 and is expected to continue leading. Meanwhile, Customized & Private Vacations are projected to grow at the fastest rate (CAGR of 8.8%) from 2024 to 2035 |

| By Age Group | Baby Boomers made up the largest share in 2023 and are expected to stay dominant. However, Millennials are catching up, with a projected CAGR of 7.9%. |

| By Traveler Type | Absolute Luxury—tailored for ultra-high-net-worth individuals—dominates. The fast-growing Accessible Luxury segment (CAGR 8.5%) caters to affluent but not ultra-wealthy travelers. |

| By Region | Europe accounts for over one-third of the luxury travel market in 2023 and is expected to retain its leading position through 2035. |

Broader Context: Other Forecasts & Trends

While Allied Market Research provides one projection, other studies offer valuable variations:

- Market Research Future estimates a much smaller base: USD 130 billion in 2023, rising to USD 250 billion by 2035, at a CAGR of 5.57%.

- Grand View Research forecasts a USD 1.48 trillion market in 2024 and USD 2.36 trillion by 2030, with a robust CAGR of 8.2%.

- Research & Markets projects growth to USD 2.32 trillion by 2030, at a CAGR of 6.7%.

- Wellness tourism—though a distinct niche—is fast-growing. Valued at USD 850 billion in 2021, it’s projected to reach USD 2.1 trillion by 2030.

These discrepancies reflect different methodologies, market definitions, and industry boundaries (e.g., whether wellness or experiences are included).

Why This Matters for the Travel Industry

- Strategic Planning: Tapping into rising demographic segments like millennials and boomer travelers requires tailored products.

- Digital Integration: Prioritizing immersive tech (VR/AR) and AI can enhance differentiation and customer satisfaction.

- Sustainability & Wellness: Designing eco-conscious and wellness-centered travel will resonate with affluent, mindful travelers.

- Competitive Benchmarking: Top players such as Abercrombie & Kent, Micato Safaris, Tauck, and TUI are closely tracking these trends and segment opportunities.

Final thoughts

The projected growth of luxury travel to over USD 2 trillion by 2035 highlights not just resilience but a fundamental shift in what luxury means. Traditional leaders like Abercrombie & Kent and Tauck still dominate with heritage and service quality, but newer strategies are setting benchmarks. Kensington Tours, for example, has tapped into multigenerational demand with a booming private villa business.

Meanwhile, luxury is leaning heavily on authenticity and wellness—affluent travelers are more willing to spend on local cultural immersion or health-focused retreats than on standardized extravagance. Major hospitality groups like Four Seasons and LVMH-backed brands are already aligning with these trends by embedding lifestyle and wellness into their offerings.

In this context, the winners won’t be those who simply scale luxury—it will be those who personalize deeply, integrate wellness, and deliver experiences that feel socially and emotionally meaningful. Luxury travel is no longer about access—it’s about connection.