Huawei Reclaims China’s Smartphone Crown in 2025

Huawei is officially back on top of China’s smartphone market and this time, it is not just a symbolic win. According to fresh data from Omdia, Huawei reclaimed the number one position in mainland China in 2025, surpassing both local rivals and Apple in one of the most competitive smartphone markets globally. Huawei smartphone market China

This is not a comeback built on hype. It is rooted in volume, ecosystem control, and a long game that now appears to be paying off.

Huawei retakes the crown in China

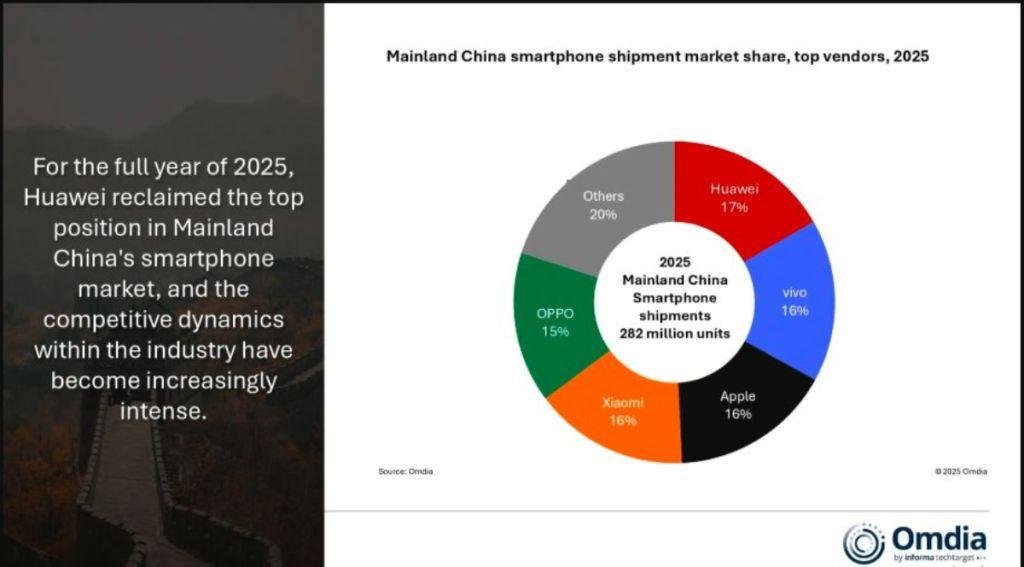

Omdia’s 2025 figures show Huawei shipped 46.8 million smartphones in mainland China, giving it a 17 percent market share. That narrowly puts it ahead of vivo, which shipped 46.0 million units for a 16 percent share, and Apple, which followed closely with 45.9 million units.

Rounding out the top five were Xiaomi with 43.7 million units and OPPO are shifting. Data from IDC shows that Huawei and Apple are now operating in almost mirror image trajectories.

IDC estimates Huawei shipped 46.7 million smartphones in China in 2025, giving it a 16.4 percent market share. Apple shipped 46.2 million units, slightly behind at 16.2 percent. A year earlier, Huawei led with 47.6 million units versus Apple’s 44.4 million.

Both brands are winning in the premium tier, but Huawei’s advantage lies in its control of the ecosystem within China. Apple still dominates on brand aspiration and loyalty, yet faces increasing friction from regulatory pressure, local competition, and slower upgrade cycles.

Rising costs threaten the mass market

The biggest cloud hanging over 2026 is cost. IDC warns that memory prices are expected to rise sharply, putting pressure on smartphone OEM margins. Arthur Guo, Senior Research Analyst at IDC China, expects these pressures to translate into a more noticeable market decline next year.

China shipped roughly 285 million smartphones in 2025, a 0.6 percent decline year on year. The slowdown hit low-end models hardest, where government subsidies had limited impact and consumers showed little appetite for frequent upgrades.

This environment favours brands like Huawei and Apple that operate higher up the value chain. Budget-focused players will find it harder to maintain profitability without sacrificing features or quality.

Huawei keeps spending while others pull back

What stands out is Huawei’s willingness to keep investing despite market headwinds. The company continues to pour resources into flagship store renovations, offline channel expansion, AI ecosystem development, and imaging technology.

This is a classic long-term play. While some competitors scale back marketing or delay innovation cycles, Huawei is doubling down on differentiation. Omdia expects 2026 to be less about raw volume growth and more about value growth, where margins, ecosystem depth, and brand strength matter most.

Huawei is positioning itself exactly for that scenario.

Conclusion: China’s smartphone race is now about ecosystems, not specs

Huawei’s return to the top is not just about shipping more phones. It reflects a deeper shift in China’s smartphone market. The era of spec-driven competition is fading. What matters now is ecosystem gravity.

Compared to Apple, Huawei has the advantage of local integration and policy alignment. Compared to Xiaomi, vivo, and OPPO, it has a tighter software story and stronger premium narrative. These differences will become even more important as costs rise and replacement cycles slow.

Reliable data from Omdia and IDC points to the same conclusion: the brands that win in China over the next few years will be those that control platforms, services, and long-term user relationships. Huawei is no longer chasing that future. It is actively shaping it.