Amdocs, Motive, and Ericsson Lead 2025 Global Entitlement Server Rankings as Cloud-Native Challengers Rise

Entitlement Servers (ES) have become a critical part of telecom operators’ digital transformation strategies. Originally designed to manage functions such as VoLTE and VoWiFi entitlements, they now underpin a much broader set of services: eSIM lifecycle management, companion device provisioning, RCS enablement, number-based authentication, and even 5G slicing. eSIM Entitlement Server

As the eSIM ecosystem expands and regulatory deadlines accelerate (e.g., Apple’s September 2025 RCS adoption), ES platforms are no longer optional add-ons — they are essential to delivering seamless, cross-device connectivity experiences.

2025 CORE Rankings

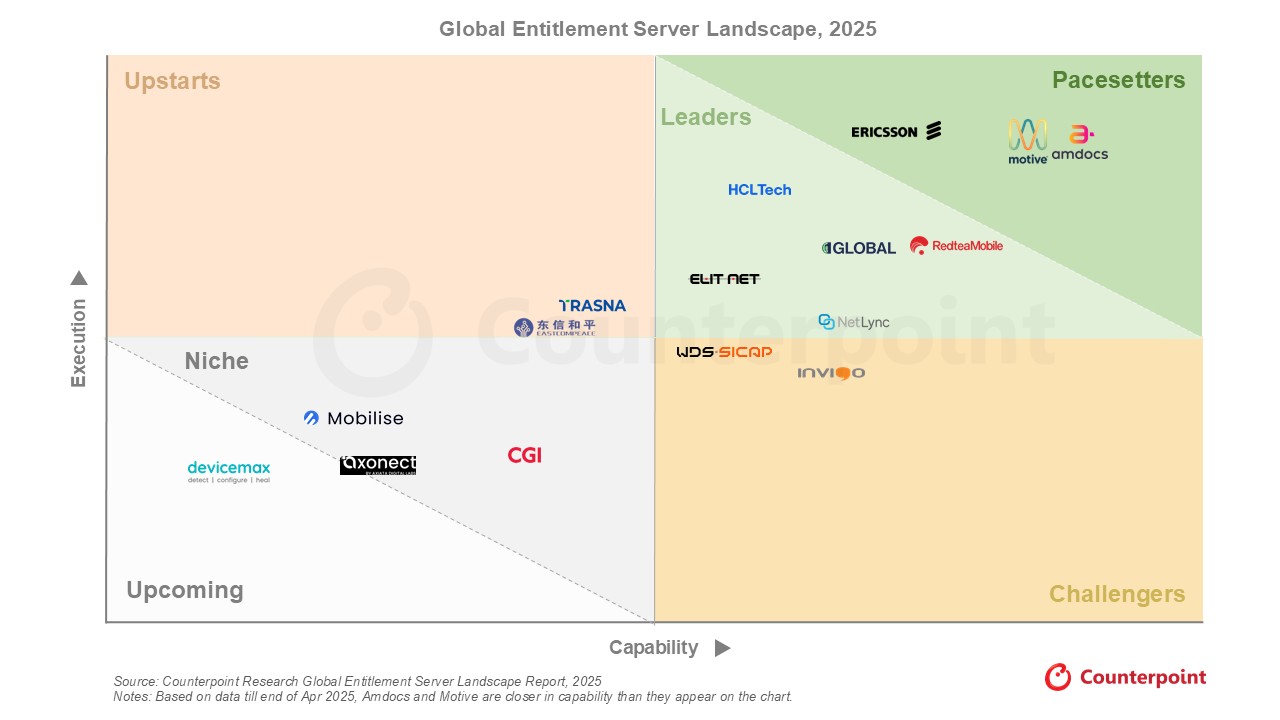

Counterpoint Research’s CORE (Competitive Ranking and Evaluation) framework positions ES vendors into four key categories based on their platform capabilities and ecosystem execution.

- Pacesetters: Amdocs, Motive, Ericsson

Excelling in both platform innovation and large-scale execution, these vendors remain the reference points in the market. - Leaders: Redtea Mobile, 1GLOBAL, Netlync, HCLTech, Elitnet

Recognized for agility, cloud-native platforms, and strong growth potential. - Challengers: Invigo, WDS-Sicap

Narrowing the gap with innovative deployments and regional expansion.

A Market in Transition

The report underlines a structural shift in the market. Traditional network-core providers such as Ericsson and Motive (formerly Nokia) now face competition from cloud-native challengers like Netlync and Redtea Mobile. This mirrors patterns seen in other telecom IT domains — for example:

- In policy control, where legacy PCRF systems gave way to virtualized PCF solutions led by more agile vendors.

- In mobile device management, where monolithic MDM tools have been replaced by unified endpoint management (UEM) platforms offering modular, API-driven capabilities.

Just as Mavenir and Affirmed Networks disrupted EPC and RAN markets, vendors like Netlync are disrupting entitlement services by offering Entitlements-as-a-Service, allowing faster onboarding for MVNOs and mid-sized operators without heavy integration overhead.

Vendor Strategies

- Amdocs and Motive: Expanding portfolios with tight OSS/BSS integration and advanced entitlement features. Their focus is helping operators accelerate deployments and maintain enterprise-grade reliability.

- Ericsson: Leveraging Tier-1 operator relationships and proven execution scale to remain a strong incumbent.

- Netlync: Positioned as a disruptor with a cloud-native, flexible model that resonates with MVNOs and operators seeking cost efficiency.

- Redtea Mobile and 1GLOBAL: Building credibility with global reach, IoT readiness, and API-first approaches, placing them close to the frontier of innovation.

Why It Matters Now

Entitlement Servers are evolving into strategic orchestration layers, not unlike how content delivery networks (CDNs) transformed the internet economy a decade ago. According to Juniper Research (2024), the number of active eSIMs will surpass 4.6 billion by 2030, making entitlement orchestration a necessity for any operator that wants to remain relevant in consumer and enterprise markets.

This aligns with insights from GSMA Intelligence, which has emphasized that automation and entitlement integration are now critical for managing multi-device connectivity at scale. Counterpoint’s report further notes that analytics, authentication, and automation will become the defining differentiators in the next phase of competition.

Varun Gupta, Senior Analyst, Counterpoint Research

With eSIM adoption accelerating across consumer devices, particularly smartphones, operators are increasingly turning to Entitlement Servers as a critical enabler of digital services and customer experience. What began as a platform to support carrier entitlements like VoLTE and VoWiFi has now evolved to power advanced use cases such as eSIM quick transfer, smartwatch provisioning and RCS. This evolution positions the Entitlement Server at the center of operators’ digital transformation strategies, bridging device innovation with seamless connectivity.

Mohit Agarwal, Research Director, Counterpoint Research

Amdocs, Motive and Ericsson have emerged as the ‘Pacesetters’ in the 2025 Entitlement Server CORE, distinguished by strong platform capabilities and execution. Amdocs and Motive continue to expand their portfolios with new use cases and tighter integration services, supporting operators in accelerating ES deployments. Ericsson has demonstrated leadership in execution, reinforced by long-standing partnerships with Tier-1 MNOs. Meanwhile, Netlync is positioning itself as a market disruptor with a cloud-native, flexible Entitlements-as-a-Service model tailored for MNOs and MVNOs seeking faster, more cost-effective adoption of entitlement solutions.

Conclusion: From Infrastructure to Differentiator

Counterpoint’s 2025 report confirms what industry insiders have anticipated: the Entitlement Server market is at an inflection point. The traditional heavyweights—Amdocs, Motive, Ericsson—bring scale and reliability, but their challenge will be maintaining agility in a market defined by rapid eSIM adoption, cross-device demand, and regulatory deadlines.

Meanwhile, newer vendors like Netlync, Redtea Mobile, and 1GLOBAL are moving quickly with cloud-native architectures and faster time-to-market models, echoing disruption seen in other telecom software segments. Their rise shows that operators are no longer satisfied with monolithic solutions; they want flexible, API-driven platforms that scale across services and geographies.

Looking ahead, the winners will be those vendors that combine execution scale with innovation velocity. Much like the shift from PCRF to PCF or from MDM to UEM, entitlement servers are becoming strategic differentiators rather than hidden utilities. As the market matures, operators will increasingly choose partners not just for their ability to deliver entitlements, but for their role in enabling new digital services, from seamless eSIM transfers to satellite IoT entitlements.

In short: Entitlement servers have moved from the background to the center of telecom transformation — and the 2025 landscape shows us who is best positioned to lead that future.