Business Travel in 2026: Why It’s Essential, Yet Harder Than Ever

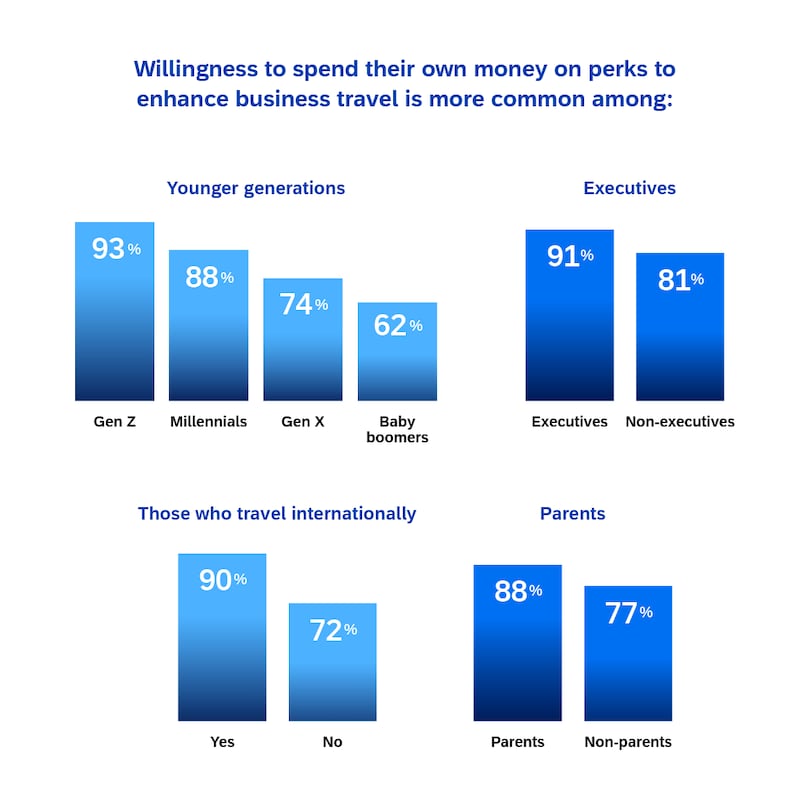

Business travel in 2025 looks nothing like it did just a few years ago. What was once a straightforward part of corporate life—boarding a plane, attending meetings, sealing deals—has become a complex balancing act shaped by shifting employee expectations, tighter budgets, health and safety concerns, and the rise of virtual alternatives. Companies are under pressure to make every trip count, while travelers themselves are juggling enthusiasm for face-to-face connections with growing fatigue, cost sensitivities, and a desire for flexibility.

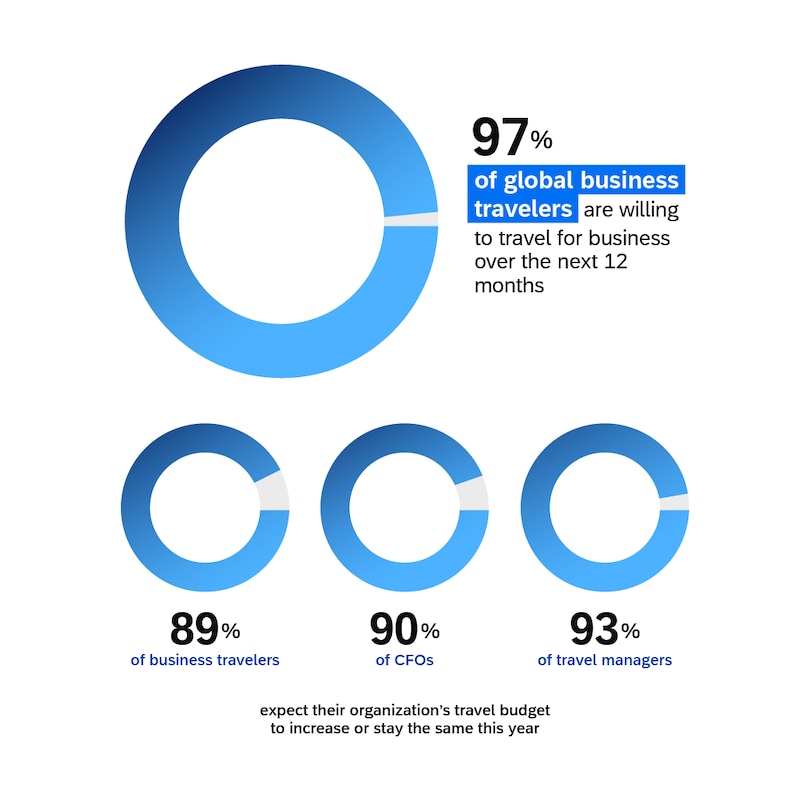

This tension sits at the heart of the seventh annual SAP Concur Global Business Travel Survey, which gathered perspectives from over 5,000 business travelers, travel managers, and CFOs across the globe. The results paint a picture of an industry in transition: travel is seen as essential to career success and company growth, yet nearly every group acknowledges significant barriers—from safety concerns and misaligned policies to budget constraints and differing views on the role of technology.

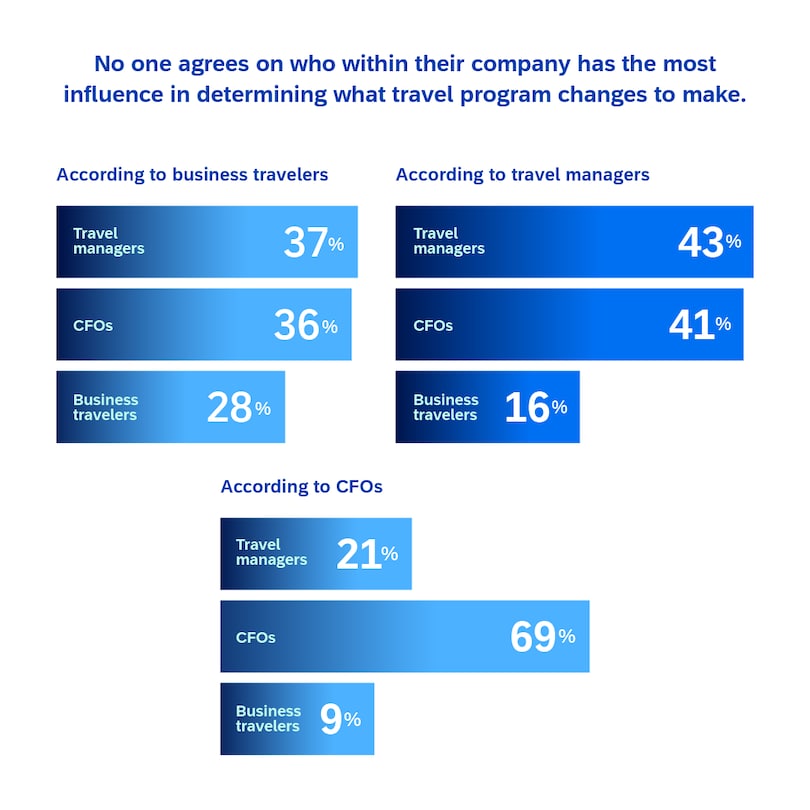

The study doesn’t just highlight numbers; it reveals contradictions. Travelers overwhelmingly want to get back on the road, but many admit they’d turn down a trip under the wrong conditions. Budgets appear stable or even rising, but restrictions on spending make the experience feel constrained. And while executives, managers, and travelers all recognize the value of business trips, their perspectives on who should control decisions—and how much flexibility employees deserve—often diverge.

Against this backdrop, the survey provides an important snapshot of where business travel stands in 2025, and where it might go next.