2026 Hotel Outlook: A Year of Modest Growth and Hidden Surprises

Hotel pricing has always been a barometer of broader economic conditions, and the Hotel Monitor 2026 by Amex GBT Consulting provides one of the clearest snapshots of where the market is heading. Unlike the sharp post-pandemic surges we saw in 2022–2023, the industry is now stabilizing. Inflationary pressures have eased in many regions, while demand has shifted in line with changing travel behaviors. Business travel is no longer simply recovering — it is restructuring, with hybrid work, sustainability requirements, and tighter corporate budgets shaping the way companies negotiate hotel programs.

At the same time, luxury hospitality is pulling away from the pack. While mid-scale and economy properties face pressure to maintain competitive rates, top-tier hotels continue to enjoy strong demand from affluent leisure travelers and executives. This mirrors findings from CBRE’s European Hotel Investor Intentions Survey 2025, which noted “a bifurcation between mass-market stability and luxury growth” across key destinations. CoStar has also reported that European luxury RevPAR (Revenue Per Available Room) outperformed all other categories in 2024–2025, highlighting how high-spending travelers are insulating the segment from broader market softness.

Against this backdrop, the Amex GBT outlook is not just a rate forecast — it’s a strategic guide for travel managers. It emphasizes the need for data-driven negotiations, stronger supplier relationships, and agility in adapting to fast-changing policies such as tourist taxes, short-term rental restrictions, and tariff-related food & beverage costs.

Global Outlook: Stability with a Luxury Twist

Overall, hotel rates are expected to remain steady in 2026. However, affluent leisure travelers are fueling demand in the luxury segment, putting pressure on corporations that book upper-upscale and high-end properties for their executives. The takeaway: luxury will cost more, even if the broader market remains flat.

Dan Beauchamp, vice president, consulting of Amex GBT, said: “This year’s forecast reveals a nuanced global environment where geopolitical uncertainties are tempering hotel rate increases.

“These insights allow businesses to make more informed travel decisions in an increasingly complex landscape. Understanding local market conditions will help companies optimize their travel budgets and strategies.”

Simon Fishman, vice president, global hotels at Amex GBT, added: “As the data shows, in today’s volatile world, the news cycles impact hotel prices in often unpredictable ways.

“Amex GBT’s hotel marketplace gives companies more flexibility and choice, providing access to more than two million properties across 180 countries, as well as over 45,000 hotels with pre-negotiated, business-friendly discounts and amenities via the Preferred Extras Hotel Programme.

“We’re enabling companies of all sizes to quickly adapt to changing business needs while accessing the best rates and traveler experiences.”

Regional Forecasts

North America

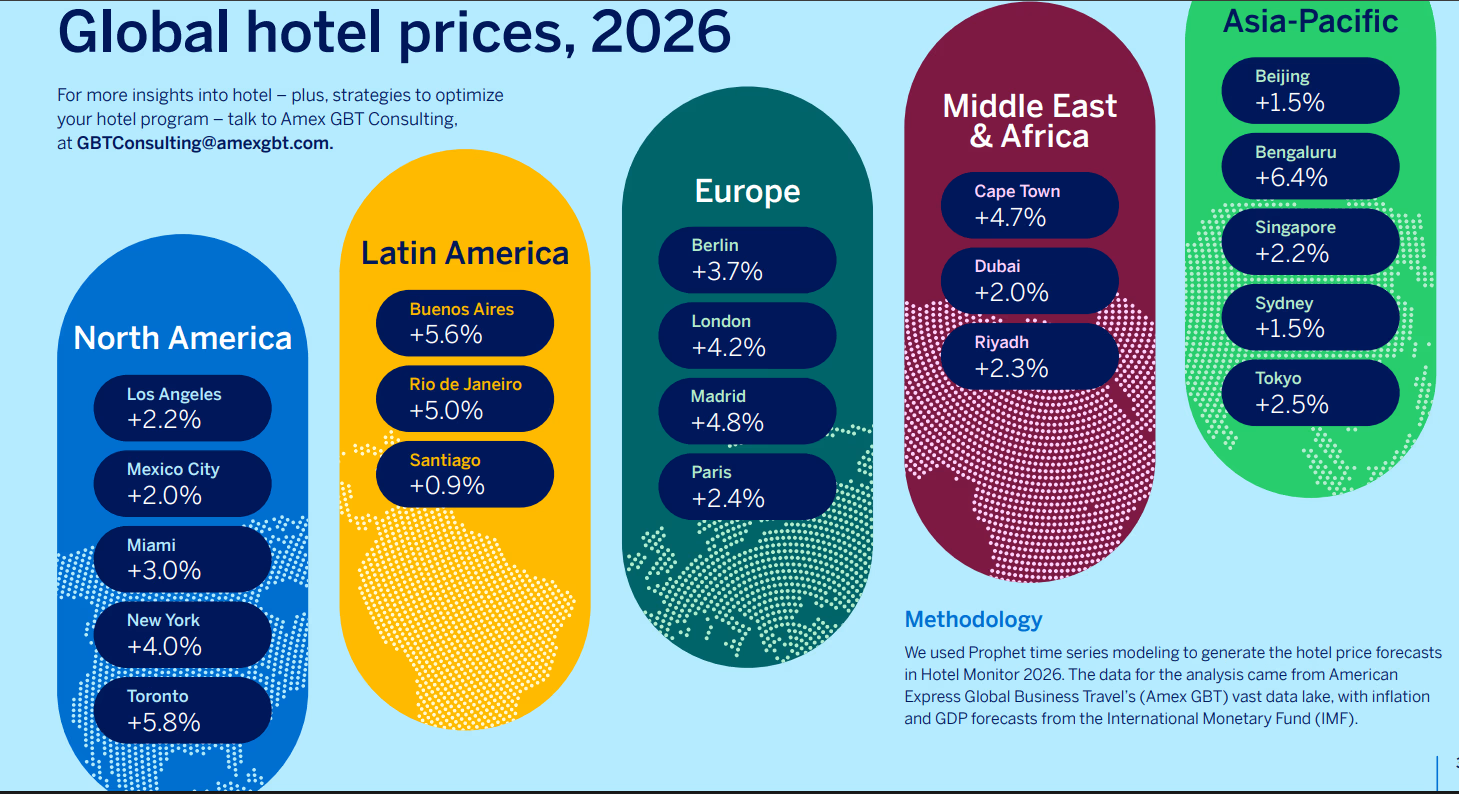

Uncertainty over U.S. tariffs could dampen inbound demand, softening hotel price growth. Still, key cities will see noticeable increases:

- New York: +4.0% despite reduced tourism forecasts.

- Toronto: +5.8%, one of the steepest climbs in the region.

- San Francisco and Chicago: around +4.0%.

Rising food and beverage costs, projected at +2.6%, may also push hotels to scale back on complimentary perks like breakfast.

Latin America

The region looks set for strong growth, supported by recovering economies and a steady construction pipeline. Highlights include:

- Buenos Aires: +5.6%, driven by economic rebound.

- Rio de Janeiro: +5.0%.

- Santiago: a modest +0.9%.

Europe

Economic moderation means only limited increases overall, though tax and policy changes could drive spikes in certain markets:

- Amsterdam: a sharp +11% rise, driven by VAT changes.

- London: +4.2%, backed by record development and sustained business travel demand.

- Barcelona and Milan: above +5%, partly due to restrictions on short-term rentals.

Middle East & Africa

Heavy investment in new hotels across the Middle East is keeping rate growth moderate. Notable figures include:

- Cape Town: +4.7%, due to limited secure hotel supply.

- Riyadh: +2.3%, as strong demand is offset by 17,000 rooms in the pipeline.

Asia-Pacific

India is the standout performer, with tech-driven cities leading the charge:

- Delhi: +6.8%.

- Bengaluru: +6.4%, reflecting booming tech and startup activity.

Elsewhere, China shows only modest growth, with some cities like Hong Kong (-1.2%) seeing declines. Japan and Singapore remain steady, supported by resilient leisure demand.

Key Trends Shaping 2026 Hotel Programs

- Luxury Costs More: Upper-tier properties will keep raising rates.

- Data as a Negotiation Tool: Companies should leverage data to demonstrate program value.

- Rate Caps: Careful cap management will be essential to contain costs.

- Sustainability: With 2030 emissions targets looming, greener travel strategies are no longer optional.

Meetings and Events: Experience Matters

Corporate events are evolving. Attendees now expect memorable, Instagram-worthy venues, inclusivity, and wellness-focused options. Hotels and venues that deliver unique, shareable experiences will have an edge in 2026.

Conclusion: Navigating a Split Market

The Hotel Monitor 2026 confirms what many in the travel and hospitality sector already suspect: the global hotel market is entering a phase of moderation and divergence. Most corporate travel buyers can expect stability in mid-range properties, yet the luxury segment is charting its own course, supported by wealthy leisure travelers and high-level business demand.

This contrasts with forecasts from STR and PwC, which expect global ADR (Average Daily Rate) growth to slow below 3% in 2026, aligning with IMF GDP projections. However, Amex GBT’s analysis goes a step further by underlining the regional volatility — for instance, Amsterdam’s projected +11% surge due to tax changes, versus Hong Kong’s forecast decline. Such disparities reinforce the importance of local intelligence rather than relying solely on global averages.

Comparisons with other market players also reveal differing strategies. CBRE highlights investment flows into luxury and lifestyle hotels, while JLL’s Hotel Investment Outlook emphasizes the growing role of sustainability in driving valuations. Amex GBT, meanwhile, focuses on program optimization and procurement strategy, reflecting its role as a travel management powerhouse rather than an investment advisor.

The key conclusion is that 2026 will not be defined by runaway costs across the board, but by pockets of sharp rate pressure — especially in luxury, tech-driven Asia-Pacific hubs, and regulation-heavy European cities. For travel managers, this means adopting a two-speed strategy: lock in competitive rates for mainstream business destinations, while preparing for higher outlays — and perhaps new negotiation tactics — in high-demand luxury and emerging markets.

The winners will be companies that embrace data, manage rate caps actively, and embed sustainability into hotel sourcing. As the global economy continues to recalibrate, those able to balance cost efficiency with traveler experience will turn their hotel programs into a genuine competitive advantage.